The University of Michigan’s preliminary consumer sentiment unexpectedly fell to its lowest level since last September, and the second lowest reading in the past two years.

But, that wasn’t necessarily the most notable part of the report. What really stood out was the low inflation expectations for October.

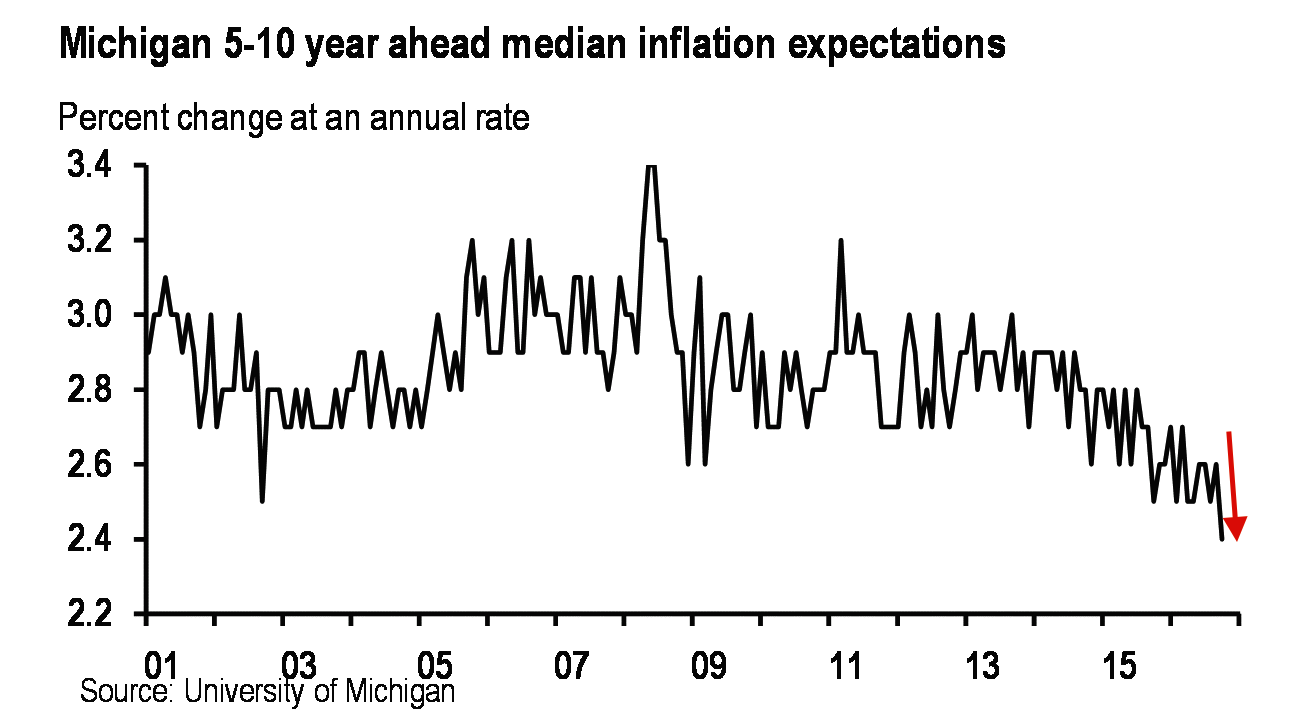

The median five-year-ahead inflation expectations dropped to a new record low for the series – to 2.4% from 2.6% – in Friday’s report. Meanwhile, the 1-year ahead index stayed flat from the prior month at 2.4%.

“It is curious to see these measures decline so much in the context of rising food and gasoline prices, which tend to have a heavy influence on consumer expectations,” added a Jefferies team led by Ward McCarthy.

So why does this matter?

Theoretically, if Americans expect inflation to be higher in the future, that gives them more incentive to spend money today.

(For example: let's say a microwave costs $100 today, and will cost $100 tomorrow. Then, it doesn't really matter price-wise whether you buy it today or tomorrow. On the flip side, if that same microwave costs $100 today, but $300 tomorrow, you're probably going to want to buy it today.)

And this sort of holding-off is a concern for the Fed given that, again, theoretically, their policy of keeping lower rates is about pulling demand forward to engineer economic growth.

"The Fed has noted low inflation expectations as cause for concern when thinking about raising rates in the past, so upcoming news on inflation expectations (including potential revisions to the Michigan survey) will likely be considered in deciding policy," JPMorgan's Daniel Silver wrote in a note.

Although he added that his team still thinks "the Fed has set a fairly low bar for the data in order to proceed with a rate hike by year-end."

For what it's worth, markets are seeing a 17.1% chance for a rate hike in November, and a 65.9% chance for a rate hike in December, according to the Bloomberg consensus.